Table of Contents

Three bearish candlesticks in a row on the four-hour timeframe saw Bitcoin (BTC) drop sharply from $64.7k to $61.7k. As a result, the Relative Strength Index (RSI) flipped from buying to selling territory with sellers overwhelming buyers on the lower timeframes.

The dominance of sellers could be further extended, if the bearish sentiment in the market continues. However, the $61.7k support level has proven to be a vital one for buyers in the past, as occasioned by the trading activity between 17 - 19 April. This could potentially serve as a rallying point for buyers in the short term.

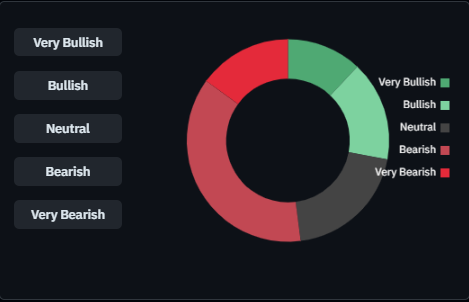

Market Sentiment Still in Favor of Sellers

According to Coinglass, the sentiment on BTC was still bearish with 52% of market participants anticipating more selling pressure on the king coin. With only 28% expressing bullish sentiment, the odds currently look high for sellers.

However, BTC has been known to experience sudden reversals, especially from key price levels. Bulls would be counting on that history to pull off a surprise pullback from $61.7k.

Meanwhile, the increasing selling pressure on BTC was reflected in sustained capital outflows. This was highlighted by the Chaikin Money Flow’s (CMF) negative reading.

If bulls are to mount a fight back, they would need to hold the support level with a bullish candle close before pushing for a reversal.

A Glimmer of Hope for Buyers

The Open Interest data from Coinalyze showed a slight increase in OI over the past 24 hours. The OI increased by 0.54% to denote some optimism in the futures market for a BTC rebound.

With the aggregated Open Interest standing at $16.406 Billion, buyers can potentially hold the $61.7k level in the short term.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.